Emissions

- Home

- Activities

- Energy and Emissions Trading

Benjamin Harms

Tel: +49 (0)561 96996-25

Email: harms(at)bfu-ag.de

Benjamin Harms

Stefan Hüsemann

Tel: +49 (0)561 96996-24

Email: huesemann(at)bfu-ag.de

Stefan Hüsemann

SURE RedCert sustainability certification

Biomass sustainability certification

Due to the European Sustainability Directive EU 2018/2001 and the German Biomass Electricity Sustainability Ordinance (BioSt-NachV) or Biofuel Sustainability Ordinance (Biokraft-NachV), there are now sustainability requirements for the use of biomass to generate electricity and heat and when used as fuel . This concerns e.g. B. also combined heat and power plants from 2 MW thermal output in the Renewable Energy Sources Act (EEG) when using biogas or biomethane as well as biomass power plants from 20 MW thermal output (e.g. waste wood incineration plants).

Since January 1st, 2022, Art. 38 and 39 of the Monitoring Ordinance (MVO) have also imposed higher requirements on the sustainability or deductibility of the biomass used in stationary systems in the TEHG. For operators, this means in concrete terms that from the reporting year 2023 they may only apply an emission factor of zero for emissions originating from the use of biomass if the sustainability of the biomass corresponds to the criteria of the Renewable Energy Directive (RED II) is proven. Which criteria have to be met depends, among other things, on the type of biomass (e.g. waste, NaWa-Ro), must be checked on a case-by-case basis and within a recognized certification system (e.g. SURE, Redcert) by a testing body (e.g. ESC Cert GmbH). ) to be certified.

Similar requirements also exist in the Fuel Emissions Trading Act (BEHG) and in the Emissions Reporting Ordinance (EBeV 2030).

We are happy to answer any questions you may have on the subject of the national emissions trading system (nEHS) or BEHG, as well as on European emissions trading (EU-ETS) or TEHG.

Your contact persons in our offices

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Christoph Franken

Telefon: +49 (0)561 96996-34

E-Mail: franken(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Christian Schmidt

Telefon: +49 (0)345 686977-15

E-Mail: schmidt(at)bfu-ag.de

Susanne Hedicke

Telefon: +49 (0)345 686977-26

E-Mail: hedicke(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Fuel emissions trading (BEHG)

Support services for distributors and responsible parties

With the introduction of the national emissions trading system on January 1st, 2021 through the Fuel Emissions Trading Act (BEHG), the legislator is pricing CO2 emissions, especially in the heating and transport sectors. Marketers of certain fuels - e.g. wholesalers, municipal utilities, manufacturers with wholesale sales and importers of fuels - are obliged to participate in national emissions trading. From the 2021 reporting period, fuels such as natural gas, diesel, petrol and heating oil will be recorded, and from 2023 other fuels such as coal, coke and vegetable oils, biodiesel.

The system starts with a fixed price phase for the certificates from 2021 (€25 per certificate) to 2025 (€55 per certificate). The auction phase begins in 2026, with a minimum price per certificate of €55.

With the need to participate in national emissions trading, those responsible have various monitoring and reporting obligations, such as the annual submission of a verified emissions report by July 31st. of the following year (for the first time by July 31, 2022) at the German Emissions Trading Authority (DEHSt) on the basis of an approved monitoring plan (for the first time for the 2024 report). Every year (by September 30th) certificates have to be handed in - and of course they have to be obtained beforehand. Those responsible who do not comply with the reporting obligations or do not do so in good time must expect severe sanctions.

On the consumer side, on the other hand, the BEHG and the Carbon Leakage Ordinance (BECV) regulate various compensation mechanisms and the avoidance of double burdens. This results in corresponding savings potential for the economy.

The German Emissions Trading Authority (DEHSt) has now announced that monitoring plans must be submitted to DEHSt by October 31, 2023 for the first time and that emissions reports for 2024 must be verified by an inspection body or an environmental verifier for the first time. For this purpose, among other things, authorized persons have to be named, a registration in the form management system has to be carried out and an electronic signature card has to be procured.

The second law amending the BEHG of November 9th, 2022 means that operators of waste incineration plants are also included in the group of marketers. The decisive factor for this is that the system requires approval under immission control law in accordance with No. 8.1.1 or 8.1.2 (for waste oil incineration) of Appendix 1 of the 4th BImSchV.

Furthermore, with the change, the fuels coal, biomethane, hydrogen and synthetic fuels have now also been included in the scope of BEHG.

When using biogenic fuel, an emission share of zero is only possible if the plant or the supply chain is certified according to a recognized sustainability system (SURE, RedCert).

The experts at BfU AG will be happy to support you in meeting the legal requirements for fuel emissions trading. Our support services include in detail:

- Assistance with opening an account in accordance with § 12 BEHG

- Setting up a virtual post office with a qualified electronic signature (DEHSt platform)

- Creation of monitoring plans according to § 6 paragraph 1 BEHG

- Preparation of the annual emissions report in accordance with Article 7 Paragraph 1 BEHG

- Communication with authorities and general questions about fuel emissions trading

- Communication with the test centers (e.g. ESC Cert GmbH) and support for test dates

Your contact persons in our offices

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Marco Kühn

Telefon: +49 (0)345 686977-14

E-Mail: kuehn(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Emissions Trading

Support services for plant operators

Since 2005, certain industrial plants have been subject to the European emissions trading system, also referred to as EU ETS (Emissions Trading System). The list of affected companies has steadily increased, so that currently more than 1,800 systems are recorded in Germany alone. At the European level, the EU ETS was mainly introduced into the 4th Trading period (2021 - 2030) transferred.

Since then, companies such as energy production, paper production, glass production, metal production and processing, etc. have had to monitor their greenhouse gas emissions and produce an emission allowance for each tonne emitted. At the beginning, even more generous allocations were made free of charge, but since the beginning of the third trading period in 2013 at the latest, plant operators have been confronted with a decreasing allocation. At the beginning of the 4th trading period in 2021, the allocation was reduced again, while at the same time the certificate prices rose significantly. At the same time, the legal requirements are constantly increasing and the operators have to fulfill comprehensive reporting and monitoring obligations.

Since the beginning of 2023, the use of biogenic fuel with zero emissions has only been possible if the plant or the supply chain is certified according to a system recognized in the EU (e.g. SURE, RedCert). In addition, the German Emissions Trading Authority (DEHSt) requires adapted monitoring plans.

The high complexity of the matter and the increasing legal regulations at EU level, supplemented by national implementation, require know-how and experience in dealing with the issue of emissions trading in order to fulfill all legal obligations as well as the remaining possibilities in the to use the area of free allocation of authorizations. Our employees support you with professional competence and many years of experience in the following areas:

- Creation of allocation applications for existing plants and new market participants according to § 9 TEHG

- Preparation of the method plan in accordance with Article 8 of the EU Allocation Regulation

- Preparation of the annual allocation data report in accordance with Article 3 of the EU Adaptation Regulation

- Creation of monitoring plans in accordance with Section 6 TEHG in conjunction with Article 12 of the Monitoring Ordinance

- Creation of the annual emission report according to § 5 TEHG

- Communication with the test centers (e.g. ESC Cert GmbH) and support for test dates

- Applications for subsequent compensation according to § 11 Para. 2 BEHG in connection with BEDV to avoid double taxation by both emissions trading systems

- Applications for the subsidy according to § 11 Para. 3 BEHG in connection with BECV (deadline June 30th) and applications for electricity price compensation to avoid "carbon leakage"

- Communication with authorities and general questions about emissions trading

Your contact persons in our offices

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Marco Kühn

Telefon: +49 (0)345 686977-14

E-Mail: kuehn(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Energy Taxes

Use of tax exemptions, reductions and relief

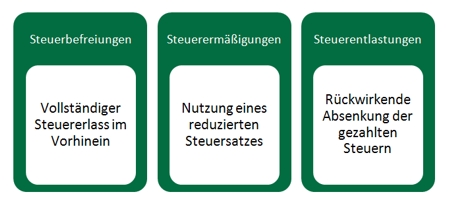

A large part of the financial burden caused by the use of energy is tax-related. To ensure competitiveness, however, a plethora of legal opportunities that companies can utilise to lower energy taxes have been created. A distinction can be drawn between the following benefits:

The aim is for all companies to be informed about tax opportunities at all times, to create a broad database of the energy sources that are used and how they are used and to make the necessary applications to the competent authority within the stipulated deadlines.

In addition to the established tax relief for certain processes and procedures in the case of manufacturing companies, the following provisions, in particular, are important to companies:

- Special compensation provision pursuant to section 63ff of the EEG (EEG surcharge cap)

- Waiver, refund or payment in special cases pursuant to section 10 of the Stromsteuergesetz (Electricity Taxation Act - StromStG) and section 55 of the Energiesteuergesetz (Energy Tax Act - EnergieStG) [Tax capping scheme for the most energy-intensive users in the manufacturing industry]

We will be pleased to assist you in the following areas with a view to pinpointing cost reduction potential and strengthening the competitiveness of your company:

- Identifying tax benefits in energy legislation

- Providing assistance in meeting requirements in respect of claiming tax exemptions, tax reductions, tax relief and other benefits

- General issues in relation to energy tax legislation

Your contact persons in our offices

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Marco Kühn

Telefon: +49 (0)345 686977-14

E-Mail: kuehn(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Renewable Energies / Combined Heat and Power

Support for electricity-generating installations

As energy costs increasingly determine the competitiveness of a business location, a company needs to check, on a regular basis, whether its own energy-generating facilities might result in cost savings in accordance with statutory support mechanisms (e.g. Erneuerbare Energien-Gesetz (Renewable Energies Act - EEG), Kraft-Wärme-Kopplungsgesetz (Combined Heat and Power Act - KWKG)).

The Renewable Energies Act (EEG) is the support mechanism for the expansion of renewable energies in Germany. It entered into force in April 2000. EEG 2004, EEG 2009 etc. followed. The EEG regulates the preferred feed-in of electricity from renewable sources (particularly biomass, wind energy, photovoltaics and hydropower) to the electricity grid and guarantees its generators feed-in payments. It also regulates the possibility of capping the EEG apportionment scheme for electricity-intensive companies.In certain cases, expert appraisals need to be submitted for energy installations (combined heat and power reports pursuant to FW 308, certification of heating networks pursuant to FW 309, EEG reports or assessments pursuant to the Treibhausgas-Emissionshandelsgesetz (Greenhouse Gas Emissions Trading Act - TEHG).

BfU AG assists industrial and commercial customers with project development, profitability analysis, project licensing under the Federal Immission Control Act, building legislation, environmental impact assessments etc. and with the legally compliant operation of EEG and CHP installations. Our services include:

- Profitability analysis of energy projects

- Energy efficiency advice (bp reduction energy costs)

- Research into support options

- Assistance with applications for capping the EEG apportionment scheme

- Licensing procedures

- Assistance with applications for support, notification obligations (e.g. BAFA, customs)

- Preparation of expert appraisals pursuant to FW 308 (CHP reports) or FW 309 and EEG by our environmental verifiers and authorised experts

Your contact persons in our offices

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Marco Kühn

Telefon: +49 (0)345 686977-14

E-Mail: kuehn(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Energy costs/advice - REMIT

Compliance-Solutions for the enegry market

Regulation 1227/2011/EU, "REMIT", makes new transparency provisions applicable in the electricity and gas market. A large number of trade agreements (transaction data) and, in some circumstances, installation data (fundamental data) need to be reported to the authorities according to defined criteria. Companies are not even aware of the reporting obligation in many cases. A number of exceptions and special provisions also sometimes make the identification and classification of the agreements to be reported difficult, often resulting in legal uncertainties for companies. Not only energy producers and traders, but also end consumers and companies that distribute energy to third parties are affected.

Together with our customers, we identify the legal obligations resulting from the Regulation. In particular, we identify the reporting obligations in respect of transaction data and fundamental data. This gives rise to a customer-specific "REMIT" concept, which assists customers with legally certain reporting.

The customer can use the formulated concept to specify software solutions together with Webware Internet Solutions GmbH. Webware Internet Solutions GmbH offers complete transmission software approved by ACER in all areas (RRM = Registered Reporting Mechanism): https://www.acer-remit.eu/portal/list-of-rrm

Your contact persons in our offices

Stefan Hüsemann

Telefon: +49 (0)561 96996-24

E-Mail: huesemann(at)bfu-ag.de

Klaus Reibenspiess

Telefon: +49 (0)6021 582254-2

E-Mail: reibenspiess(at)bfu-ag.de

Christian Schmidt

Telefon: +49 (0)345 686977-15

E-Mail: schmidt(at)bfu-ag.de

Dr. Antonia Goldner

Telefon: +49 (0)40 30238698-3

E-Mail: goldner(at)bfu-ag.de

Hans-Ulrich Terme

Telefon: +49 (0)561 96996-14

E-Mail: terme(at)bfu-ag.de

Stefan Bender

Telefon: +49 (0)6441 96305-12

E-Mail: bender(at)bfu-ag.de

Tobias Brenne

Telefon: +49 (0)6441 96305-13

E-Mail: brenne(at)bfu-ag.de

Benjamin Harms

Telefon: +49 (0)561 96996-23

E-Mail: harms(at)bfu-ag.de

Any further questions?

E-Mail: info(at)bfu-ag.de

Tel.: +49 (0)561 96996-0